Brow Lift

Conveniently located to serve the areas of Tampa and Lakeland, FL

Dr. Jacob Gerzenshtein is a highly skilled cosmetic surgeon dedicated to helping Tampa patients achieve youthful and radiant facial aesthetics. Among his advanced procedures is the brow lift, a transformative treatment designed to smooth the forehead and restore a refreshed, well-rested appearance. Dr. Gerzenshtein is one of the few surgeons in the Tampa area offering the innovative endoscopic brow lift, a minimally invasive approach that reduces discomfort and shortens recovery time.

Contents

- 1 Before and After Photos

- 2 What is a Brow Lift?

- 3 A Minimally Invasive Option

- 4 Why Consider a Brow Lift?

- 5 Why Choose Dr. Gerzenshtein for a Brow Lift?

- 6 Schedule Your Consultation

- 7 FAQ

- 7.1 What should I expect in consulting with a plastic surgeon?

- 7.2 How long do the results of a brow-pexy hold up? Is one type of brow lift better than another?

- 7.3 I am in the process of losing weight, should I wait to undergo eyelid or brow lift surgery procedures?

- 7.4 When do I call Dr. Gerzenshtein?

- 7.5 Is there anything available to reduce swelling and bruising after browpexy?

- 7.6 Do I need laser resurfacing (CO2 or erbium laser) chemical peeling (TCA or phenol, or blue peel), along with browpexy (brow lift) or as an alternative?

- 7.7 How do I take care of drains left after my browpexy/brow lift surgery?

- 7.8 Is there a difference between patients of varying ethnic heritage with respect to choice of procedure or outcome?

- 7.9 What is the immediate post-brow lift recovery like? How about long term post browpexy recovery?

- 7.10 When is brow lifting unsafe?

- 7.11 What is the Endotine Brow Lift?

- 7.12 What is the Endoscopic Brow Lift?

- 7.13 What is the Customary, Standard, or Traditional Brow Lift or Browpexy?

- 7.14 What are the different brow-pexy (brow-lift) procedures?

- 7.15 What is a browpexy or brow lift?

- 7.16 I need a brow lift, but I don’t want one. Is there anything that can be done to help correct my brows, frown lines, and forehead wrinkles?

- 7.17 How do I wash and/or cleanse my brow lift incisions?

- 7.18 What are the some of the risks and complications of brow lift surgery?

- 7.19 What is recovery like after a brow lift?

- 7.20 What is the typical price for a browpexy or brow lift?

- 7.21 What can I do to prepare for browpexy (brow-lift)?

- 7.22 Application of endoscopic techniques in aesthetic plastic surgery?

- 7.23 What medications are typically prescribed after a brow lift operation?

- 7.24 What are some things to watch for after a brow lift?

- 7.25 Is a brow lift ever covered by health or medical insurance?

- 7.26 How do I care for my brow lift incisions?

- 7.27 I have had a brow lift and I am not satisfied with the results. Is there anything that may be done to improve my browpexy outcome?

- 7.28 Will a brow lift address the crinkles between my brows, or the lines on my forehead?

- 7.29 Am I a good candidate for a brow lift?

- 7.30 Am I the right age for a brow lift? Am I too young? Am I too old?

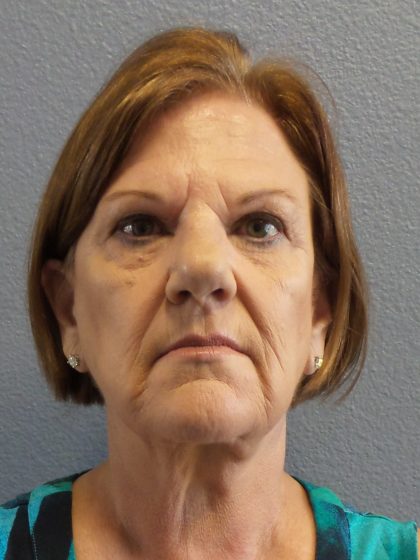

Before and After Photos

What is a Brow Lift?

A brow lift, also known as a forehead lift, repositions and tightens the skin and tissues of the forehead to:

- Smooth deep forehead wrinkles and fine lines.

- Lift sagging brows that contribute to a tired or angry appearance.

- Improve the appearance of drooping skin in the upper eyelids.

A Minimally Invasive Option

The endoscopic brow lift is a modern, less invasive approach to forehead rejuvenation. It involves small incisions through which a tiny camera and specialized instruments are inserted. This method allows Dr. Gerzenshtein to lift and reposition the brow with precision, offering several benefits:

- Minimal scarring due to smaller incisions.

- Reduced swelling and discomfort.

- Faster recovery compared to traditional methods.

Why Consider a Brow Lift?

A brow lift can address aesthetic concerns caused by aging, stress, or genetics, such as:

- Deep creases and wrinkles across the forehead.

- Drooping brows that overshadow the eyes.

- Horizontal lines that create a tired or aged look.

Why Choose Dr. Gerzenshtein for a Brow Lift?

Dr. Gerzenshtein combines advanced surgical techniques with an artistic eye to achieve natural, harmonious results. He provides personalized care, taking the time to understand each patient’s goals and recommending the most suitable treatment approach. His expertise in minimally invasive procedures like the endoscopic brow lift ensures optimal outcomes with less downtime.

Schedule Your Consultation

If you’re considering a brow lift, Dr. Gerzenshtein invites you to explore the options available. Contact his Tampa office to schedule a consultation and learn more about how a brow lift can help you achieve a youthful, refreshed appearance.

Contact UsFAQ

What should I expect in consulting with a plastic surgeon?

When preparing for plastic surgery, knowing what to expect during your consultation with a plastic surgeon in Lakeland, FL is crucial. Each surgeon has a unique approach, but most follow a set routine to ensure consistent outcomes and proper post-operative care.Personalized Consultation Process Every plastic surgeon in Lakeland, FL has their own style when consulting with patients, but a thorough physical examination is almost always part of the process. Surgeons typically focus on areas of concern—such as jowls, smile lines, or a sagging neck—to assess the patient’s needs and desires. This step allows the surgeon to create a personalized surgical plan.For example, Dr. Gerzenshtein takes time to understand the patient’s primary concerns, whether it’s the full smile lines or sagging neck. He then combines his professional assessment with the patient’s preferences to develop a mutually agreeable treatment plan. This personalized approach ensures the patient’s expectations align with the surgical possibilities. Pre-Operative Instructions Once you and your plastic surgeon in Lakeland, FL finalize the treatment plan, you will receive a pre-operative instruction sheet. These instructions are vital to ensure the success of the procedure. For instance, you may need to discontinue certain medications, like aspirin, two weeks before surgery. This reduces the risk of complications and ensures a smooth surgical process. Not adhering to these pre-operative instructions could result in a delayed procedure, so it’s important to follow them closely to avoid unnecessary setbacks.Pre-Surgery Physical Exam and Lab WorkBefore your procedure, either a full physical examination or a review of an examination conducted by your primary care physician will be required. This ensures you are physically prepared for the surgery. If needed, your plastic surgeon in Lakeland, FL will order additional lab work or studies to confirm your overall health.During this stage, you will also have a detailed discussion about the potential risks and complications of your surgery. For example, your surgeon will thoroughly review the risks related to rhytidectomy (facelift surgery) and provide an honest assessment of what to expect in terms of recovery and outcomes.Discussing the Risks and BenefitsA key part of your consultation is understanding the potential risks and benefits of the procedure. Every surgery comes with some level of risk, and it’s essential that you feel fully informed about both the rewards and the possible complications.Your plastic surgeon in Lakeland, FL will also give you a clear understanding of the likely results, setting realistic expectations for your appearance after the procedure. Pre-operative photographs may also be taken, which helps track your progress from before the surgery to the final results.Post-Operative Care Instructions Before the surgery, you will also receive detailed post-operative care instructions. These will include guidelines on how to care for the incision sites, any medications you may need to take, and activity restrictions to help your recovery go smoothly.You’ll also receive prescriptions for post-surgery medications and tips on how to handle any discomfort during the recovery process. Proper post-operative care is critical for minimizing complications and ensuring the best possible results from your surgery.ConclusionConsulting with a plastic surgeon in Lakeland, FL is a comprehensive process that involves personalized care, thorough physical exams, and a detailed discussion of risks and benefits. By understanding what to expect during your consultation and following the pre- and post-operative instructions, you can set yourself up for a successful surgery and a smooth recovery.Learn more about consultation with plastic surgeon here.

How long do the results of a brow-pexy hold up? Is one type of brow lift better than another?

The results of a brow-pexy, when performed correctly, can typically last for up to 10 years. While the procedure cannot stop the aging process, it can give the appearance of turning back the clock by repositioning sagging skin and tissue. After the surgery, aging will resume, but with less tissue to be affected by gravity, meaning the results of a brow-pexy will continue to provide a more youthful look for a significant amount of time.Why Does the Aging Process Continue?It’s essential to understand that a brow-pexy cannot permanently stop the effects of aging. The results of a brow-pexy are long-lasting but cannot completely halt the skin’s natural tendency to loosen over time. However, since the surgery involves removing excess skin and repositioning tissue, the face has less to sag or droop as it ages. This gives the illusion of setting back the clock while gravity takes less of a toll compared to the pre-surgery state.Are Some Brow Lifts Better Than Others?Different types of brow lifts offer varying results, and choosing the right procedure depends on your individual needs. Endoscopic brow lifts, for example, involve smaller incisions and may be less invasive. However, they might not address severe skin excess. On the other hand, open brow lifts, which involve a longer incision, can be more effective for patients with more significant sagging skin.Beware of minimally invasive procedures that promise long-lasting results with little surgery. Often, such quick-fix methods may not provide the same durability as traditional techniques, leaving patients disappointed and needing revision surgery within months. If you’re looking for long-term results of a brow-pexy, it’s essential to discuss the pros and cons of each option with your surgeon.How to Maintain Brow-Pexy ResultsWhile the results of a brow-pexy are long-lasting, there are steps you can take to help prolong them. Protecting your skin from sun damage, maintaining a healthy lifestyle, and following your surgeon’s post-operative care instructions can all help in maximizing the longevity of your surgery.In conclusion, the results of a brow-pexy can last a decade or longer when done properly. The best approach is to choose a skilled surgeon and a procedure tailored to your needs. While no brow lift can halt aging, a well-executed surgery will provide years of rejuvenated and natural-looking results.Learn more about the types of brow lift and how they differ to one another through thisstudy.

I am in the process of losing weight, should I wait to undergo eyelid or brow lift surgery procedures?

The short answer is yes, especially if you are well away from your target weight. Losing significant amounts of weight after a face lift may cause recurrence of sagging. Nasolabial folds, jowls, “turkey neck,” etc. may result from more loose skin produced as a result of facial fat loss. If you are very close to target weight, you should probably wait until you’ve reached it, since disruption in your exercise/diet routine caused by face lift surgery and recovery from the rhytidectomy or face lift surgery may set you back a bit.

When do I call Dr. Gerzenshtein?

On the night you return home after face lift surgery and on the first day after face lift surgery call the office to check in and let us know how you are doing. Thereafter, call if you have pus-like (greenish or yellowish) or foul smelling drainage, temperature greater than 100 degrees, redness that is spreading or greater on one side, excessive swelling or bleeding, uncontrolled by light pressure, especially if you notice a difference between two sides, increased pain that is intolerable, and not relieved by medication, Also call if you believe you are experiencing side effects from any of the prescribed medications like rash, swelling away from the operative site, difficulty breathing, nausea/vomiting, headache, difficulty breathing, chest pain, loss of sensation, strength, or motion. Finally, call us about absolutely anything you would consider unexpected or unusual after face lift surgery.

Is there anything available to reduce swelling and bruising after browpexy?

Intermittent application of ice packs, or more economically frozen veggie packs will diminish swelling, as will a compression garment designed specifically for face lift patients. When it comes to reducing bruising two natural substances, bromelain, and arnica can help. Their properties are listed below.

Do I need laser resurfacing (CO2 or erbium laser) chemical peeling (TCA or phenol, or blue peel), along with browpexy (brow lift) or as an alternative?

Skin resurfacing, whether laser (CO2 or erbium laser) or chemical (TCA or phenol, or blue peel) and face lifting (rhytidectomy face lift surgery), are not mutually exclusive. In fact, resurfacing and rhytidectomy are complimentary. Skin resurfacing addresses fine wrinkles, pigment changes, and irregularities associated with aging. Facelifting addresses creases, skin and fat excess, as may be found in smile lines, marionette lines, jowling, and “turkey neck.” To get the best possible result from facial rejuvenation, it is often necessary to perform rhytidectomy, and some type of laser or chemical resurfacing either at the same time or after recovery from the face lift.

How do I take care of drains left after my browpexy/brow lift surgery?

Generally, any drains (present after the procedure) are discontinued the day after face lift surgery, if drainage is excessive, the drains stay in until drainage is deemed minimal. Should the tube opening start draining, dry it, then place 4X4 gauze around the skin where the drain comes out, tape the dressing. Please strip the tube every time you empty the drain, and record the drainage.

Is there a difference between patients of varying ethnic heritage with respect to choice of procedure or outcome?

“Beauty is in the eye of the beholder.” What is considered attractive in some social or ethnic circles is frowned upon in others. For this reason, ethnic, including social, and/or religious considerations determine a patient’s opinion of what is desirable. Only this consideration may alter the choice of one procedure over another. Assuming the outcome is predefined, that is the goals of face lift surgery are clearly delineated, outcomes should be uniform with few exceptions. Genetic factors and complexion may predispose a patient to loss of pigmentation, or an increase in the same. This is generally observed with resurfacing modalities, like laser CO2, phenol, or TCA peels, rather than face lifting itself. Keloid formation would be an unusual, but cosmetically devastating complication, and is more prevalent in the darker skin patient.

What is the immediate post-brow lift recovery like? How about long term post browpexy recovery?

On waking from anesthesia, you will find yourself in the recovery room with dressings, and ice or gel pack in place. Your vision may be blurry owing to protective ointment applied to your eyes during surgery. You will be able to depart once sufficiently recovered from anesthesia, and lucid. A friend or family member will drive you home and stay with you for the next 2 days to help you with activities of daily living. Initially, you will feel tired and run down. This will be at its worst in the first several days after surgery. The lethargy may be attributed to general anesthesia and will improve substantially over the first week after a blepharoplasty. Discharge from your incisions should be minimal over the 1st 2 days after surgery, though bleeding may occur with excessive activity, and at least some spotting over the dressing is normal. The dressing present after surgery will be removed, along with a special garment, during the first post-operative visit. Drains, if present, will likely be discontinued at the same time. If dilute local solution was used (superwet or tumescent technique) pain and discomfort will be mild initially, and will increase and peak within two days. The pain will then subside over the course of one to two weeks. Use of prescription pain medication will help significantly.Nausea and vomiting in the postoperative period is not uncommon and has to do with the type of anesthesia used and overall patient sensitivity to the various medications. It generally resolves within 1 to two days after surgery. Increasing fluid intake (provided you have no history of heart or fluid trouble), especially via one of the “ade” (Gatorade, PowerAde, etc.) solutions available for sports use, combined with anti-emetic medication should minimize this problem.Use of opiate pain medication, combined with inactivity, and dehydration may lead to constipation. Increasing fluid intake will help this as well, especially in combination with walking, and use of a stool softener.Swelling and bruising peak within three days of surgery and gradually subside over the following week, but may persist for up to four weeks. The two sides rarely bruise to the same degree, and a mild difference in swelling is normal, however, if swelling is notably different you will need to come in for evaluation immediately. Your appearance early on in the course of recovery may be distorted by a significant amount of swelling, giving you a bloated, puffy, pale appearance with blotchy bruising. Do not be disturbed, this will pass, and you will look and feel much better within several weeks.Apart from swelling and bruising, most patients will experience tightness and numbness over the forehead if a browlift was performed with the blepharoplasty. Most numb places will regain sensation over several months, in the case of the open or coronal browlift approach; this may take up to six months. Expect improvement in all of your symptoms, worsening over the course of recovery is not normal and needs to be addressed via a prompt phone call. If a browlift was performed, hair may be lost around the incision 1 month after the surgery. It will usually return within 4 months after the initial loss. Healing incisions will adopt a pinkish hue that should gradually fade over the next six months to a year.Some patients react to absorbable (inside) suture, small pustules or whiteheads along the incision may signal this. The suture may be removed in the office if the problem becomes bothersome.Facial camouflage make-up may be applied two weeks after surgery to conceal bruising, and healing incisions. Telltale signs of blepharoplasty surgery will resolve within 1-2 months. The final result will be obtained once all of the swelling has resolved, typically around six months.

When is brow lifting unsafe?

When is Brow Lifting Unsafe?Considering a brow lift can be an exciting decision for many seeking to enhance their appearance. However, it’s crucial to understand the potential risks involved. Knowing when brow lifting may be unsafe ensures you make informed choices about your health and safety during the procedure.What Are the Risks of Brow Lifting?When considering a brow lift, it’s essential to recognize when the procedure may be unsafe. Certain factors can pose significant risks. Commonly reversible issues include medications that interfere with normal blood clotting, interact with anesthetics, or impair healing. Patients can usually suspend these medications temporarily before surgery, reducing potential complications.More serious health problems can make a brow lift unsafe. Conditions such as coronary artery disease or pulmonary disease significantly increase the chances of adverse outcomes, especially with general anesthesia. Additionally, certain connective tissue disorders pose risks. Conditions like Ehlers-Danlos Syndrome (Cutis Hyperelastica), Cutis Laxa, Pseudoxanthoma Elasticum, Progeria (Hutchinson-Gilford Syndrome), Adult Progeria (Werner’s Syndrome), Meretoja Syndrome, and Idiopathic Skin Laxity may serve as relative or absolute contraindications for rhytidectomy.If you require relief from minor pain after a brow lift, consider taking Tylenol. Always consult your surgeon before taking any medication.ConclusionUnderstanding when brow lifting is unsafe can help you make informed decisions about your procedure. Always consult with a qualified plastic surgeon to discuss your health history and any potential risks. Being proactive about your health ensures a safer and more successful brow lift experience.Learn more about the risks of browhere.

What is the Endotine Brow Lift?

What is the Endotine Brow Lift?The Endotine brow lift is a minimally invasive procedure that lifts and stabilizes the forehead, reducing wrinkles and repositioning sagging eyebrows. Surgeons use the ENDOTINE® Forehead device to deliver precise, long-lasting results. Consequently,this procedure helps people achieve a more youthful, refreshed appearance without extensive surgery.How Does the Endotine Brow Lift Work?During the procedure, the surgeon makes three small incisions behind the hairline—two near the outer scalp and one in the center. Using endoscopic guidance, the surgeon releases the forehead skin and soft tissue. This allows smooth repositioning of the eyebrows while removing or weakening the muscles responsible for furrows and wrinkles.To secure the lift, the surgeon drills two small holes into the outer skull and inserts the ENDOTINE® Forehead device. These plastic hooks hold the lifted skin in place. After adjusting the skin over the hooks, the surgeon removes any excess skin and closes the incisions. The minimal scarring remains hidden within the hairline.What to Expect After the ProcedureMost patients resume normal activities within 1 to 2 weeks after the procedure. Some swelling and bruising may occur, but the discreet placement of the incisions ensures any scars stay hidden.The Endotine brow lift delivers long-lasting results, leaving the forehead smoother and lifting the eyebrows in a natural way.Why Choose the Endotine Brow Lift?Minimally invasive: The small incisions allow for faster recovery and minimal scarring.Stable results: The ENDOTINE® Forehead device securely supports the lifted skin and brow tissues for long-term results.Natural appearance: The procedure enhances your appearance without creating an overly tight look.ConclusionThe Endotine brow lift offers an effective, minimally invasive solution for lifting the forehead and eyebrows, helping you achieve a more youthful appearance. As a result of the support from the ENDOTINE® Forehead device, the procedure provides long-lasting, natural-looking results. Consult a qualified plastic surgeon to see if this procedure fits your needs.Learn more about the ENDOTINE® Forehead devicehere.

What is the Endoscopic Brow Lift?

The endoscopic brow lift is a minimally invasive surgical procedure designed to address brow ptosis, or drooping, with minimal skin excision. This technique suits younger patients with brow sagging and crow’s feet. It also addresses excess upper eyelid skin but is not for those with significant forehead excess.How the Endoscopic Brow Lift is PerformedUnlike traditional brow lifts, the endoscopic brow lift uses three small incisions. The incisions go behind the hairline. This approach minimizes visible scarring and speeds up recovery. The procedure involves the use of a thin camera, or endoscope, which allows the surgeon to view and adjust the brow and forehead tissues with precision.Devices Used in the ProcedureA variety of devices can be used for fixing the brow in its new position. Dr. Gerzenshtein, for example, prefers the Endotine® Forehead fixation device. This device helps in securing the brow tissue and ensuring that the results are stable and long-lasting. Combining the Endoscopic Brow Lift with Other ProceduresThe surgeon can combine the endoscopic brow lift with other procedures for optimal results. For instance, the procedure may include a lateral brow lift to address any excess skin. Doctors frequently combine it with lower blepharoplasty or a midface lift. This combination helps address multiple areas of concern for a comprehensive facial rejuvenation.Benefits and ConsiderationsThe primary advantage of the endoscopic brow lift is its minimally invasive nature, which results in smaller incisions, less scarring, and a quicker recovery time compared to traditional brow lifts. However, it is most effective for patients who do not have significant excess skin on the forehead. If the procedure requires significant skin removal, the surgeon may need to perform additional treatments.ConclusionThe endoscopic brow lift offers a subtle yet effective solution for brow ptosis and related concerns. By opting for this procedure, patients can achieve a refreshed and youthful appearance with minimal disruption to their daily lives. Discussing your specific needs and goals with a skilled surgeon will help determine if the Endoscopic Brow surgery is the right choice for you.Learn more about endoscopic brow enhancementhere.

What is the Customary, Standard, or Traditional Brow Lift or Browpexy?

A Customary, Standard, or Traditional Brow Lift effectively addresses sagging eyebrows and forehead wrinkles. It remains one of the most commonly performed surgical procedures for these issues. While different surgeons may have their own approach, the traditional brow lift generally refers to the open approach, using a coronal incision to lift and rejuvenate the upper third of the face.The Open Approach: A Classic TechniqueIn this procedure, a coronal incision is made either behind or along the hairline. The incision allows access to the forehead tissues, which are then lifted to a more youthful position. The open brow lift involves undermining the forehead down to the level of the eyebrows. This can be done either on top of the bone, known as the subgaleal approach, or on top of the bone covering, which is the subperiosteal approach.Muscle Repositioning and RemovalA key aspect of the traditional brow lift is the removal of specific muscles that contribute to frown lines and forehead wrinkles. These include the corrugators, procerus, and depressors—muscles responsible for frown lines between the brows. In some cases, the surgeon removes sections of the frontalis muscle. This muscle raises the eyebrows and causes horizontal forehead lines, so its removal creates a smoother appearance.Addressing Skin LaxityOnce the underlying tissues are repositioned, the surgeon tightens the skin by removing a sliver of skin at the edge of the incision. This reduces any sagging and creates a more youthful and refreshed look. The standard or traditional brow lift offers this comprehensive rejuvenation, making it ideal for those with significant brow drooping and forehead wrinkles.Incision Placement and ScarringThe surgeon can place the incision behind the hairline or along the forehead hairline based on the patient’s hairline and preference. Placing the incision behind the hairline makes the scar nearly invisible, while placing it along the hairline allows for more direct access to forehead tissues, which may be beneficial for some patients.Is the Traditional Brow Lift Right for You?While the Customary, Standard, or Traditional Brow Lift is highly effective, it requires a longer recovery period compared to less invasive procedures. The benefits, however, include more dramatic and long-lasting results. This approach suits patients with significant brow sagging and forehead wrinkles. It also benefits those seeking comprehensive facial rejuvenation.Choosing an experienced surgeon for a traditional brow lift ensures natural-looking results that enhance your facial aesthetics. The surgeon tailors the procedure to fit each patient’s unique facial structure and aesthetic goals, ensuring an optimal outcome.Read more about traditional brow lifthere.

What are the different brow-pexy (brow-lift) procedures?

When considering a brow lift, it’s essential to know about the various techniques available to help you achieve your aesthetic goals. Brow lifts, also known as browpexies, are procedures designed to elevate sagging brows, reduce forehead wrinkles, and refresh your overall facial appearance. In this article, we will explore the different brow-lift procedures and their unique approaches to achieving a youthful, natural look.Customary or Traditional Brow LiftThe traditional brow lift, also known as the standard or customary brow lift, involves making an incision across the scalp, usually along the hairline or within the hair-bearing area. This technique allows the surgeon to lift and reposition the brows while removing excess skin. Though more invasive, this method delivers long-lasting results, making it a great option for patients with significant brow sagging and deep forehead wrinkles.The traditional brow lift provides comprehensive rejuvenation by addressing the entire brow area. However, it requires a larger incision, leading to a longer recovery period compared to other brow-lift procedures.Endoscopic Brow LiftThe endoscopic brow lift is a less invasive procedure that utilizes small incisions made behind the hairline. The surgeon inserts a thin camera (endoscope) through these incisions, lifting the brow and forehead tissues while minimizing scarring. This method is ideal for patients with mild to moderate brow drooping and fewer wrinkles, as it provides natural results with a quicker recovery time.For those looking for subtle improvements, the endoscopic brow lift is one of the most popular different brow-lift procedures due to its precision and minimal invasiveness.Endotine Brow LiftThe Endotine brow lift uses a unique implantable device called the Endotine to secure the brow tissue in place during the healing process. This approach can be combined with an endoscopic brow lift for a more stable result. The Endotine device is gradually absorbed by the body, eliminating the need for permanent hardware.This procedure offers controlled lifting, making it a great choice among different brow-lift procedures for patients seeking a balance between minimally invasive techniques and reliable results.Trans-blepharoplasty Brow Lift (TransBleph Brow Lift)The surgeon performs the Trans-blepharoplasty (TransBleph) brow lift through an incision in the upper eyelid. It is often combined with upper eyelid surgery for optimal results. This method uses the ENDOTINE® device to reposition the brow from beneath the skin, offering both an eyelid and brow lift in one procedure.This dual approach makes the TransBleph brow lift an excellent choice among different brow-lift procedures for patients who want to address both their brow and upper eyelid concerns in a single surgery.Lateral Brow Lift or Temporal LiftThe lateral brow lift, also known as the temporal lift, focuses on the outer portion of the brow. This technique is ideal for patients who want to improve sagging at the edges of the brows without altering the central forehead area. Surgeons usually place the incisions within the hairline at the temples, which helps to conceal any scars.Patients often choose the lateral brow lift for a subtle, natural enhancement of the brow’s outer contour. This technique provides a specialized option, distinguishing it from other brow-lift procedures.Mitek Tac-it® Endoscopic Brow LiftThe Mitek Tac-it® endoscopic brow lift is a variation of the traditional endoscopic technique but uses Mitek bone-anchoring devices to secure the brow position. This method offers stability and long-lasting results, delivering a strong lift while maintaining a minimally invasive approach.Patients seeking a durable brow lift with fewer incisions often prefer the Mitek Tac-it® approach, making it a standout among different brow-lift procedures.Which Brow Lift is Right for You?With so many different brow-lift procedures available, selecting the right one depends on your specific goals and the degree of brow drooping you wish to address. Factors such as the amount of sagging, skin elasticity, and your desired recovery time will influence the best approach for you.Consulting with an experienced plastic surgeon can help determine which brow-lift technique is most suitable for your individual needs, ensuring you achieve the desired results with minimal downtime.In conclusion, each of these different brow-lift procedures offers unique benefits, from minimally invasive techniques to more comprehensive lifts. Understanding the options can help you make an informed decision about the best brow lift for you.Learn more about brow lift techniques in thisstudy.

What is a browpexy or brow lift?

A browpexy, commonly known as a brow lift, is a cosmetic procedure designed to elevate sagging eyebrows and address aging signs in the upper third of the face. As we age, the skin around the forehead and brows can lose elasticity, leading to drooping eyebrows and the formation of wrinkles. A browpexy effectively lifts the brows, smoothens forehead wrinkles, and enhances the overall facial appearance.Signs of Aging Treated by a BrowpexyThe brow lift targets several aging-related concerns, particularly those in the upper face. Some common signs of aging that browpexy addresses include:Forehead Wrinkles (Transverse Rhytids):Horizontal lines across the forehead, often referred to as “spaghetti wrinkles.”Glabellar Lines:Deep furrows between the eyebrows caused by frowning, also known as “11 lines.”Bunny Lines:Wrinkles that appear where the nose meets the forehead.Brow Ptosis:Drooping or sagging eyebrows that can make the face appear tired or angry.Excess Upper Eyelid Skin (Dermatochalasis):Often resulting from sagging brows, this condition can lead to heavy eyelids.Crow’s Feet (Periorbital Rhytids):Fine lines around the outer corners of the eyes.The Brow Lift ProcedureDuring a browpexy, the surgeon lifts sagging eyebrows, smooths out forehead creases, and may remove some of the muscles responsible for frown lines. This not only repositions the eyebrows but also helps reduce the appearance of wrinkles, giving the face a more refreshed and youthful look. The procedure can also tighten the skin around the eyes, reducing crow’s feet.Combining a Browpexy with Other TreatmentsFor deeper wrinkles or more advanced signs of aging, a browpexy may be combined with other treatments to enhance the results. Some common combinations include:Laser Resurfacing:Using CO2 or erbium lasers to rejuvenate the skin, reduce fine lines, and improve overall texture.Chemical Peels:Phenol or TCA peels can be used alongside a brow lift to address deeper wrinkles and improve skin tone.Combining these treatments with a browpexy can deliver a more comprehensive rejuvenation, targeting multiple signs of aging at once.Benefits of a Brow LiftA browpexy offers numerous benefits for those looking to rejuvenate their upper face. These include:Restored Brow Position:Lifting sagging eyebrows to their natural, youthful position.Reduced Wrinkles:Smoothing out forehead lines, frown lines, and crow’s feet.Enhanced Facial Expression:Creating a more refreshed and approachable look by alleviating the tired or angry expression caused by sagging brows.Long-Lasting Results:While the procedure can’t stop the aging process, the results can last for many years, offering a youthful appearance for a long time.Is a Browpexy Right for You?A browpexy is ideal for individuals experiencing sagging brows, forehead wrinkles, or other signs of aging in the upper face. If you are considering the procedure, consulting with an experienced plastic surgeon is essential. They can assess your specific concerns and recommend the best approach to achieve your aesthetic goals.In conclusion, a browpexy, or brow lift, is a highly effective solution for those looking to address drooping brows and signs of aging in the forehead. By lifting the brows and smoothing wrinkles, it provides a refreshed and youthful look, enhancing both appearance and confidence.Learn more about brow lifthere.

I need a brow lift, but I don’t want one. Is there anything that can be done to help correct my brows, frown lines, and forehead wrinkles?

Generally speaking, a severe amount of skin laxity in the forehead cannot be corrected as well with less invasive methods, as they may be with a full coronal brow-lift. Some of the treatments may help improve the situation, but as a rule of thumb, the more invasive the procedure, the more dramatic the result. Laser resurfacing, chemical peeling, botox, injectable fillers can all, to a variable degree achieve some improvement, but they should not be thought of as a substitute for a traditional brow lift. In fact, when combined with an upper facial rejuvenation, such techniques can dramatically improve the outcome of brow lift surgery. Beware of the quickfix fad procedures and “newer” modalities, and technologies that promise results to match, or even come remotely close to those obtained through surgical intervention. Often, the before and after pictures are of different quality, out of focus, taken from a different angle, etc. The best way to tell whether a set of pictures is legitimate is to compare the background, lighting, distance from camera, and quality of a zoom view. The majority of before and after photos are missing most of such details, and probably for a good reason.

How do I wash and/or cleanse my brow lift incisions?

If your eyes become matted gently cleanse with a warm washcloth. You may shower 24 hours after surgery only if you have a handheld shower and you can direct it at away from your face, keeping your head dry. 48 hours after surgery, remove dressing if present, leaving steri-strips in place. You may now wash your face and hair. When shampooing and washing your hair, do it with your head and hair flung back, in a salon style fashion. Be gentle around the incisions but wash the area thoroughly. It is best to use a mild, unscented soap for washing your face. When washing, and when drying, pat over the incisions, don’t wipe. Do not use the “hot” setting when blow-drying your hair, some skin areas may have lost sensation temporarily and you will not be able to feel yourself getting burned when too close or when using the hair dryer too long in one area. If you dye or bleach your hair, you may resume 1 month after surgery. Do not make use of a steam room, sauna, bathe or submerge in a pool or whirlpool, for at least 3 weeks after surgery.

What are the some of the risks and complications of brow lift surgery?

Risks associated with brow lift surgery may be grouped into anesthesia risks, and surgical complications. Anesthesia risks are common to any surgery and are discussed elsewhere. Events such as cardiac complications (heart attacks or myocardial infarctions), allergic or anaphylactic reactions, lung-related adverse effects (pulmonary embolism, pneumonia), kidney, liver, or any other organ system problem would all fall under that category. Complications related to the act of surgery may be grouped into risks involved in undergoing any procedure, and risks particular to brow-pexy, or brow lifting. Risks of any procedure include bleeding or hemorrhage, infection, whether skin, soft tissue, abscess, or necrotizing, acute and chronic pain, and acute or chronic skin sensitivity. Delayed healing is more common is persons with vascular disease and smokers. Fluid collections known as seroma may occur in the dissected space, this typically resolves with fluid drainage. Fine results are anticipated but never guaranteed. Dissatisfaction with the cosmetic outcome of any procedure will require procedural correction.Complications related to brow lift surgery include asymmetry, which may need surgical correction through re-operation, inadequate correction of the low brow, over-correction of the brow leading to either a “surprised look,” or even an inability to close the lids (which may lead to its own problems with the cornea, tearing, dryness, etc. and is usually a result of a combination procedure with upper blepharoplasty – persistent symptoms of this nature may require surgical reconstruction). Alopecia, or hair-loss around the incision is not a frequent complication, but is not rare, and my necessitate hair replacement or re-positioning for correction. In some cases, the endoscopic brow lift approach must be changed to the open approach. This is dictated by factors unforeseen preoperatively, such as inadequate exposure, inadequate correction, uncontrollable bleeding, etc. Contour abnormalities, divots, lumps, bumps, wrinkles may result from a brow lift. This is caused by the dissection, or by the use of a fixation device. When presenting weeks after surgery, irregularities may be a result of internal scarring. They typically resolve without issue, but may need correction in some cases. Recurrence of the brow droop is also a common negative outcome in brow lift surgery, in which case the brows need to be re-positioned. Fixation devices, as a matter of a rare complication may also penetrate the skull, and cause intracranial bleeding and/or injury necessitating emergent treatment. Visible or “feel-able” hardware may need to be removed once a stable result has been achieved. “Dog ears” are more of a possibility with the open approach, and may also require secondary correction. Scars are not particular to the browpexy procedure, but their prominence, or asymmetry if present, after this procedure may be hard to mask, and may require revision brow lift surgery or other means of making the inconspicuous. Dissection in any brow lift whether open or endoscopic proceeds in a space that is close to sensory nerves which supply or give feeling to the front scalp, and the forehead. Cutting such nerves will result in loss of sensation to the innervated skin. This is much less common with the endoscopic approach, and is guaranteed to happen for the scalp skin in the back of the incision after the open or coronal approach. Sensation usually returns without a problem. Damage to nerves that innervate muscles of the face is also possible but rare.

What is recovery like after a brow lift?

Depending on the type of brow lift performed, recovery can last from as little as several days to as long as three to four weeks. Assuming the most invasive form of brow lift was carried out; the sequence would include a possible overnight stay. In either instance, assuming an uncomplicated course, immediate recovery from anesthesia takes from one half to a full hour. Patients go may go to a private suite prior to discharge, or when staying overnight, to an appropriate room. Drains would likely be present, and be removed the following day. Swelling is worst at 48-72 hours, and should gradually subside thereafter. Sleeping with the head elevated on several pillows will do much to aid in drainage and diminish facial puffiness. Pain begins to improve significantly after 3-4 days. Oral pain medication will do a lot to alleviate most of the discomfort. Numbness about the central forehead does not affect the majority of patients, but it is not rare. Numbness behind the hairline incision in the case of open or coronal brow lifting is a drawback to this type of procedure. This is why endoscopic brow lifting is preferred to the coronal approach. If loss of sensation is present, parenthesis may take from six to twelve months to resolve. Bruising is normal, and may change color over days. Uneven swelling and bruising are not normal, and may signal a bleeding problem, early on, and infection later in the course. Both of which are not very common. In any case, notifying Dr. Gerzenshtein as soon as possible is essential to a good outcome. Other findings that may merit the same action are loose sutures, cloudy drainage, fever, or redness. Visible sutures are removed within 5-7 days. Sutures or staples behind the hairline and ears are left in for 10-14 days. Make-up may be applied after one week. Light exercise may begin 7-10 days after surgery, while more strenuous activity should wait until after one month has passed.

What is the typical price for a browpexy or brow lift?

The price for a brow lift varies very widely, and depends on several factors.How competitive is the market?How reputable is the surgeon?Is the rhytidectomy done in the hospital or office?Is the rhytidectomy done under general anesthesia, or sedation?How invasive is the brow lift, or how long will it take?Based on the above the bottom line can range from five thousand to fifty thousand dollars. Why the discrepancy? The more saturated the market is with surgeons who fancy themselves brow lift operators; the more likely they are to try to undersell the competition. Of course, if the surgeon is completely booked, has an impeccable record for outstanding results, and/or is recognized nationally, he or she will operate on the most affluent patients, and the asking price will be substantially higher. Procedures performed in the hospital will run more because of the customary mark-ups, unless your plastic surgeon has worked out a special deal. General anesthesia introduces the anesthesiologists’ fee. Finally, the particular technique matched to the patient’s problem may require less than two hours of operating time, or more than six. This not only affects facility, and anesthesia fee, but most surgeons will charge considerably more for a more involved operation.

What can I do to prepare for browpexy (brow-lift)?

If you are not a local resident, you should plan to arrive at least a day prior to the procedure to familiarize yourself with your temporary habitat. You will need to remain here, whether at a local hotel, or with a relative or friend for approximately one week after surgery. You will also need to notify the office of your planned residence. If a resurfacing procedure is planned along with face or brow-lifting for total facial rejuvenation, you will need to pre-treat for approximately six weeks before surgery. Our aestheticians will help with this. Of course all prohibited medications must be stopped at least 2 weeks prior to surgery. Make sure there is someone who can help you get about for the first several days after surgery as swelling and discomfort may limit your ability to do so. Preparing meals in advance, having someone cook for you, or planning to order out are all things to consider and have arranged prior to surgery. Ice packs should be stocked to last for 48 hours. A less expensive alternative may be frozen vegetable packs.If you are a nicotine user you must quit nicotine 6 weeks before surgery. That means you must quit smoking tobacco, chewing tobacco, chewing nicotine gum, using the nicotine patches, or any other imaginable method of nicotine delivery. A pre-operative history and physical must be performed by your primary care physician, within four weeks of having surgery. You have, or will be given a list of prohibited medications. Please refer to this list to guide you in substances incompatible with, or not conducive of surgery. The most important of such medications not take for at least 2 WEEKS prior to surgery include drugs which interfere with clotting (‘thin”) your blood such as aspirin, or any non-steroidal anti-inflammatory drugs (NSAIDs) like ibuprofen (advil,motrin,nuprin) or naproxen (aleve, naprosyn), blood thinners (coumadin or lovenox for example), and/or vitamin E. You must check with your primary care physician or cardiologist prior to discontinuing the aforementioned drugs. The prohibited medication list includes any herbal or non-traditional substances or medications, and diet medications. Do not consume any alcohol, or use any illicit drugs for at least two weeks prior to surgery. If you develop a viral illness, cold, upper respiratory tract infection, urinary tract infection, sores, boils, or any other new medical problem before surgery, notify our office as soon as possible. If you are not spending the night in the hospital or recovery suite after your surgery, please make arrangements to have a responsible friend, or relative drive you to the facility, and drive you home after the surgery.

Application of endoscopic techniques in aesthetic plastic surgery?

It is common in this day and age to use dilute local anesthetic before making an incision. This type of pre-emptive anesthesia reduces post-brow lift discomfort immensely. In general it takes several hours for the effects of the local to wear off. Soreness improves over several days following brow lift surgery, and is very well controlled with oral pain medication.

What medications are typically prescribed after a brow lift operation?

When prescribed, antibiotics are extremely important to take as directed for proper blood levels and effect. Antibiotics may cause gastrointestinal symptoms, loose bowel movements, or yeast infections. Prompt notification is the key. Anti-emetic (nausea), analgesic (pain), a sleeping aid, and a stool softener should also be prescribed, and taken as directed. If you are sensitive to narcotic medication, start off slowly, with ½ or ¼ dose and work up (this class of pain medication may not only make you disoriented, lethargic and nauseated, but also constipated, and can cause you to have a difficult time urinating).You should never mix Tylenol™ with certain combination narcotics that already contain acetaminophen, as this may cause damage to your liver. If you do not want to take the prescribed pain medication for any reason, simply substitute it with Tylenol™. Any of the prescribed medications may cause an allergic reaction. If you notice swelling, redness, raised wheals over any portion of your skin notify the office. If you have trouble talking, breathing, have tongue and mouth swelling; consider it a medical emergency and cal 911 without delay. Finally, do not drink alcohol while using the prescribed medicines for at least two weeks until after surgery. This is because there are dangerous interactions between alcohol and pain, nausea, and insomnia medication. Alcohol may render the antibiotic useless, worsen fluid exacerbation, and result in a dehisced incision from bumps or falls sustained while inebriated.

What are some things to watch for after a brow lift?

Uneven swelling and bruising may be the result of bleeding, which would require a prompt decompression. Uneven swelling later in the postoperative course may signify an infection, which is treated via antibiotics and possibly drainage. Cloudy drainage, fever, or spreading redness all point to an infection as well.

Is a brow lift ever covered by health or medical insurance?

There are two basic reasons to perform a brow lift with or without blepharoplasty, one is to improve appearance, the other is to improve vision. Obviously operations done for purely cosmetic reasons would not be covered by a health insurance policy. Functional impairment, however, is a different matter. Requirements vary between insurers, but generally speaking, patients with documented visual field loss that is improved at least 30% by manual elevation of the brows may seek coverage. Patients who feel as though the upper part of their visual field is blocked, have difficulty keeping their eyes open as the days wears on, or suffer from spasms or headaches as a result of constantly trying to elevate their brows would be considered candidates for a functional brow lift and/or blepharoplasty.

How do I care for my brow lift incisions?

Do not manipulate the incisions until the first post-operative appointment (24 hours after surgery). The routine closure will have non-absorbable suture without an external dressing and a coat of antibiotic ointment. On occasion incisions will be closed with absorbable suture and covered via steri-strips. At the initial visit any post-operative dressing will be removed, so please bring a scarf with you for the trip home, as your hair will be disheveled. You may shower or wash over the steri-strips or exposed suture material. Do not bathe, or submerge, for at least 3 weeks after surgery. Be gentle and pat when applying soap, rinsing, and drying. After drying, steri-strip covered incisions do not need any more attention. After drying over incisions with exposed suture, apply a thin layer of triple antibiotic ointment. If present, when the edges of the steri-strips become frayed, trim them. With time, as very little is left behind, they may be removed (usually 2-4 weeks). In some cases additional tape will be used for removing tension from the suture line, or placing tissue in the desired position of healing. If such tape is present, it will be re-applied at the first office visit, and you will be shown how to do this on your own.As a general rule, keeping the incisions clean and dry will result in the most aesthetically pleasing healed incision with minimal scarring. Do not allow scabs to accumulate, if present you may gently tease it off with peroxide soaked q-tip. While tending to the incision, watch for signs of problems as outlined below. It is not routine to have drains placed at the time of surgery, however, at times, if bleeding is diffuse, and cannot be addressed via surgical maneuvers (clipping, suturing, tying) it may be safer to leave behind a drain in attempting to prevent a hematoma (blood collection). If present, the drains will be removed within one to three days. If non-absorbable sutures were used, they will be removed 7 days after surgery. All incisions behind the hairline/scalp will have clips or suture removed 10-14 days from surgery. Do not expose incisions to the sun and/or tanning UV light for at least 1 year, however, you may begin tanning 4 weeks after surgery while keeping incisions covered. If sun exposure in unavoidable, use a product with SPF of at least 30. On the third day after surgery, discontinue gel pad application.

I have had a brow lift and I am not satisfied with the results. Is there anything that may be done to improve my browpexy outcome?

Unsatisfactory results may be divided into two categories, true surgical complications, and incongruence between patient expectations and achieved results. Depending on the severity of a true complication, it may or may not be significantly improved via further surgery. Improper re-draping, inadequate tightening, poorly placed scars, and prominent scars may all be improved by revision browpexy. You should discuss your dissatisfaction with your surgeon to see if he or she feels that the situation may be helped, prior to seeking the advice and intervention of Dr. Gerzenshtein.

Will a brow lift address the crinkles between my brows, or the lines on my forehead?

Facial rejuvenation surgery will address loose skin most effectively. Wrinkles or rhytids that form secondary to this skin excess will no doubt be taken up by excising this extra skin caused by gravity and aging, and tightening the remaining skin. Small creases around the mouth will need a form of skin resurfacing to fix effectively. This may be in the form of carbon dioxide laser, erbium laser, trichloroacetic acid (TCA) peel, phenol peel, Blue Peel ™. Either an endoscopic forehead or brow lift, or an open forehead or brow lift include the division and partial removal of the corrugators, depressor, and procerus muscles. Muscles that are responsible for the furrowing between the brows and just above them whilst frowning. Repositioning, or excising the forehead skin will address the forehead lines. So the short answer is that a brow lift can take care of most, but not all wrinkles, folds. Any residual lines, crinkles, and creases will be handled effectively via skin resurfacing modalities.

Am I a good candidate for a brow lift?

Age related changes in the face usually become apparent in the fourth decade of life. The degree to which a patient is affected has to do with multiple factors, the most likely of which are smoking, significant weight-loss, prolonged or intense sun exposure, and genetic predisposition. In fact, some patients would benefit from a brow lift as early as in their thirties. There are variations on a brow lift, with respect to depth of dissection, incision placement, and open versus endoscopic techniques that may be tailored to the individual patient’s needs, in terms of how aggressive the correction has to be to obtain a good result. The ideal candidate for a brow lift would have prominent crosswise forehead creases, furrowing, “bunny lines,” and”crow’s feet.” Apart from this, a good candidate would be emotionally secure, with appropriate reasons for desiring surgery, at a stable time in his or her life, and be in good health.

Am I the right age for a brow lift? Am I too young? Am I too old?

Typically, there is no right age for browpexy. Brow Lifting can be classified as reconstructive, restorative, or cosmetic. Reconstructive brow lifting is typically performed as early as adolescence because it addresses either the total absence of facial musculature, as may be found in certain syndromes, or paralysis of the facial muscles, whether traumatic, or congenital. Restorative brow lifting is used to set back some of the changes brought about by aging. This is performed to restore natural eyebrow position, typically in conjunction with removal of excess upper eyelid skin. The creases or “crow’s feet” to the outside of the eyes are also addressed. It is called restorative browpexy because the plastic surgeon attempts to replace the skin back to it original position. Browpexy and blepharoplasty performed to restore a normal field of vision in a patient with acquired brow drooping is also a form of restorative browpexy, performed for functional rather than cosmetic reasons, with the fringe benefit of improvement in appearance. Patients may be candidates for this as early as their thirties. It all has to do with how severe the changes are, and what the patient desires. Typically, the massive weight loss patient will present at an earlier age, while most will present later in life. Minimal changes will likely be corrected with less invasive methods, whereas severe aesthetic disturbances may need a full coronal approach combined with other surgical and non-surgical modalities. Provided the patient is healthy, there is no upper age limit to browpexy or brow lift surgery.